Insurance

Transform processes & advance growth

Bring down operational costs, reduce processing times and ensure customer-first experiences with intelligent automation solutions for insurance.

Request Demo

End to end automation

Policy Management

Extract data, update insurer and broker systems, and interact with human requests, all while meeting regulatory and statutory requirements. Create more engaging experiences with policyholders using a combination of Unmand's Robotic Process Automation (RPA), forms builder and data extraction capabilities.

Complex documents

Claims Processing

Processing insurance claims, rendering a decision and issuing a payout requires pages of forms and complex supporting materials. The Unmand platform can automatically classify and extract critical information across all insurance sectors. Additionally, Unmand can validate submitted information against master data, confirm line items sum to total charges and then package and send a claim for approval or further review.

Improve processing times

Quote Automation

Quote creation historically involves extracting risk information from disparate systems or multiple data sources and entering the information into a broker or insurer system. The Unmand platform can automatically classify, extract, map and quote risk information for brokers and insurers across all insurance sectors. Unmand is able to validate submitted information against master data and then package the quotation to the client or send it back for review.

Related Case Studies

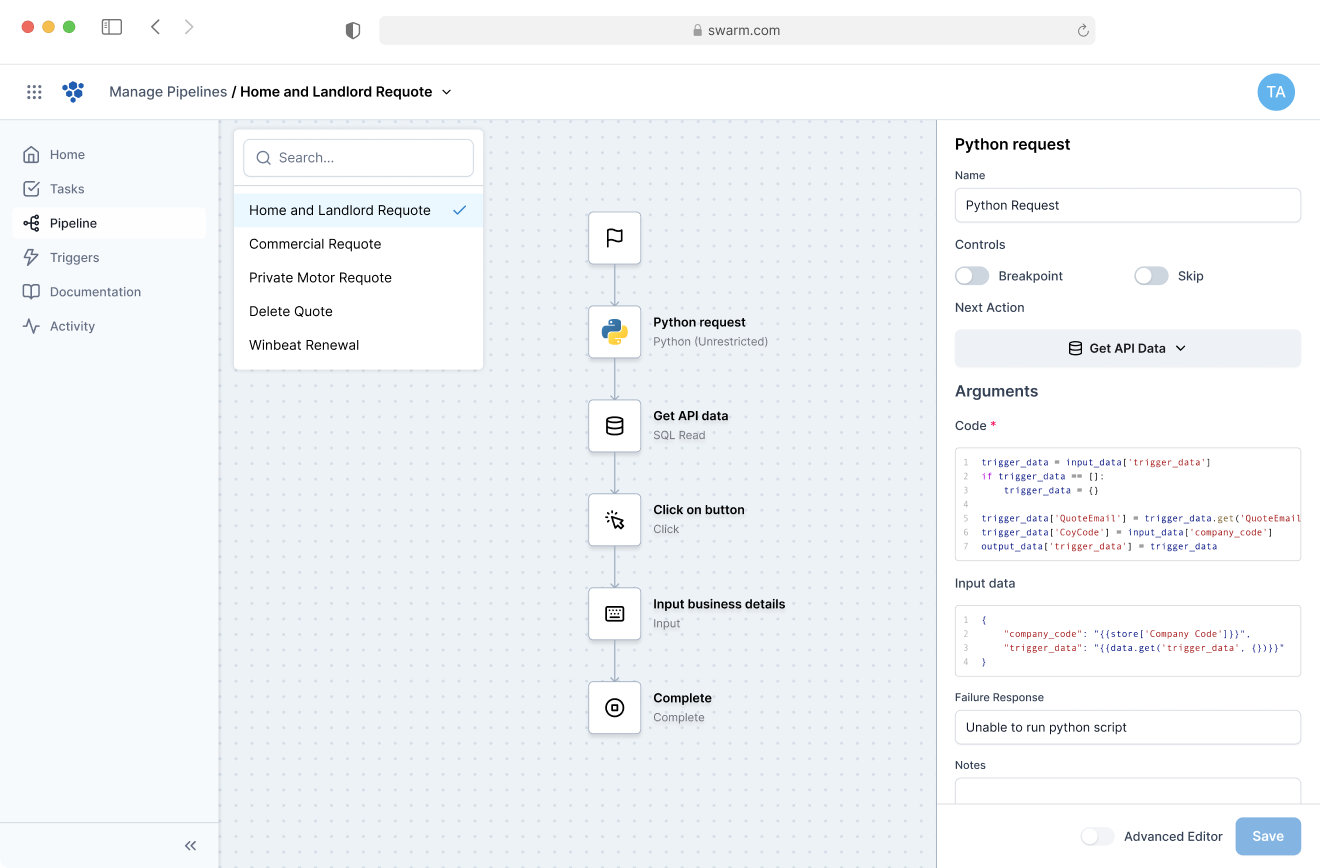

Swarm

Automate repetitive tasks with robotics

A software robotics platform for insurance to automate all mundane tasks and join disparate systems. Automate email triage, quote creation, underwriting and claims decisioning and more.

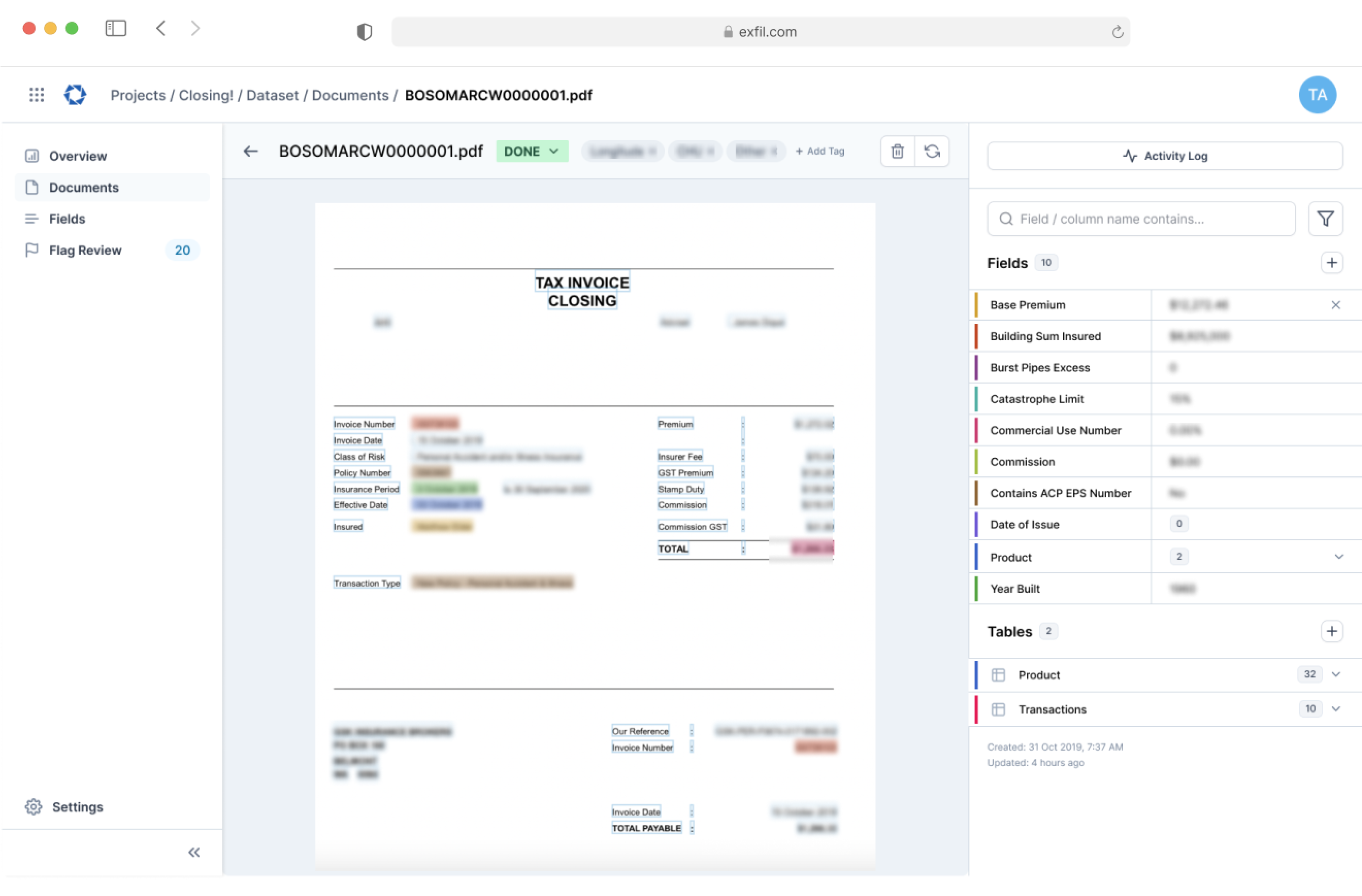

Exfil

Turn documents into structured data

An insurance-ready solution for automating the capture of any document data. This includes quotations, closings, remittances, invoices, underwriting and claims documentation and more.

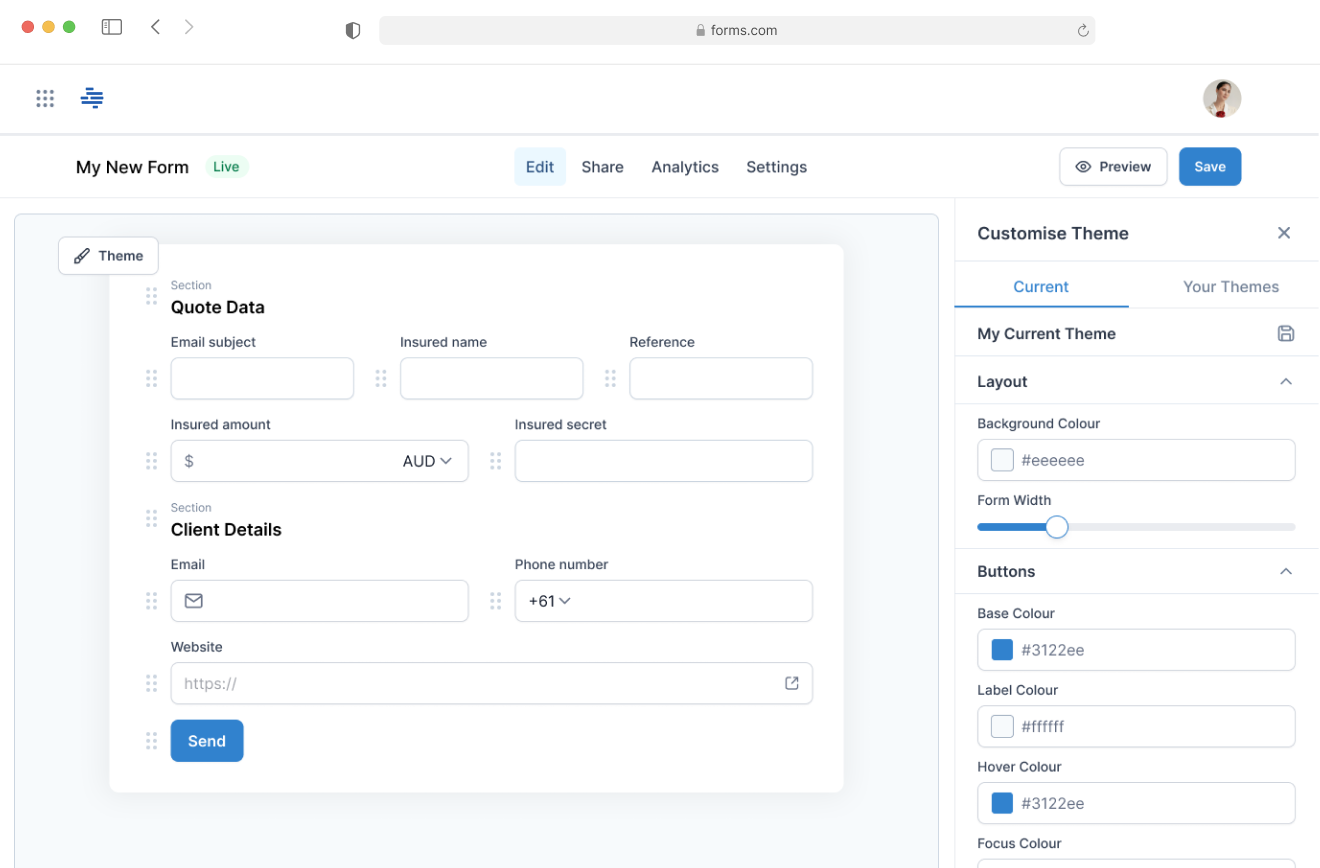

Forms

Capture data with forms

An intelligent on-line forms builder that will take the complexity out of your forms. Create forms across your entire value chain, from quote stage right through to underwriting and claims.